2025 Recap

The Year the Three Pillars Came Together

Welcome to our 2025 year-in-review — a look back at a year that transformed Hydration from a trading and lending protocol into full-stack DeFi infrastructure.

Three years ago, we launched the Omnipool. Two years ago, we added borrowing and lending. This year, we completed the third pillar: HOLLAR, Hydration’s native stablecoin.

Trading, lending, and stablecoin infrastructure — all under one roof. Here’s how 2025 unfolded.

What We Accomplished

GIGADOT and GIGAETH launched in April and July respectively — composite yield tokens that combine staking rewards, lending interest, trading fees, and liquidity incentives into single assets. No manual compounding, no hopping between protocols. GIGADOT now holds over 1% of the entire DOT supply. GIGAETH grew to $13M TVL within months of launch. Users can hold these assets, supply them as collateral, or loop them for leveraged yield positions. Alongside these, HOLLAR’s ecosystem tokens — HUSDC, HUSDe, HUSDT, HUSDS — give users yield-bearing stablecoin exposure through dedicated liquidity pools.

HOLLAR launched in September, completing Hydration’s three-pillar vision. It’s a decentralized, overcollateralized stablecoin with two innovations: the HOLLAR Stability Module (HSM) provides direct, algorithmic price support rather than relying on slow arbitrage through secondary markets, generating revenue rather than burning reserves. Protocol-executed partial liquidations calculate the minimum collateral needed to restore a position’s health and liquidate only that amount — users keep more of their position, and the system stays efficient. Demand exceeded expectations. The borrow cap started at 2M and has been raised multiple times. Current status: 3.9M HOLLAR borrowed against a 7M cap, at a 5% borrow rate. The peg held through the October crash. In December, Polkadot’s OpenGov approved a $3M DCA into HOLLAR as part of Project Individuality — the Treasury’s push to diversify its on-chain holdings. When the network’s own treasury adopts your stablecoin, that’s validation.

Asset diversification expanded significantly. At the start of 2025, Hydration supported primarily Polkadot-native assets. Now, users can access Ethereum assets via Snowbridge’s trustless bridging — no intermediaries, no custodians. Solana assets are accessible via Wormhole integration. More ecosystems means more liquidity sources, more assets, and more users who can access Hydration without friction.

Strategies made DeFi accessible. Complex yield opportunities that would normally require multiple transactions and protocol-hopping are now available in one click. Users can enter GDOT, GETH, or HOLLAR strategies and start earning immediately — no expertise required. This is DeFi that works for everyone, not just power users. The adoption of GDOT shows the demand: over $23M TVL in a single strategy.

UX improvements continued throughout the year. Block time was halved from 12 to 6 seconds, leading to faster execution and paving the way towards 2-second blocks. Unified deposit flows simplified onboarding, letting users deposit assets from multiple chains through streamlined interfaces rather than navigating complex bridging steps manually.

Security held. 2025 tested every protocol’s resilience. Hydration’s infrastructure held through market stress — the result of conservative parameter settings, multiple security audits, an active bug bounty program on Immunefi, timely responses to issues found, and infrastructure designed with security as a first principle.

Financial services for DAOs. Hydration has become infrastructure for on-chain treasury management. The Polkadot Treasury has DCA’d over 14.7 million DOT through Hydration into stablecoins across four governance proposals. The $3M HOLLAR accumulation from Project Individuality adds another layer. But this isn’t just about Polkadot — any DAO can use Hydration for capital-efficient, transparent, on-chain treasury operations.

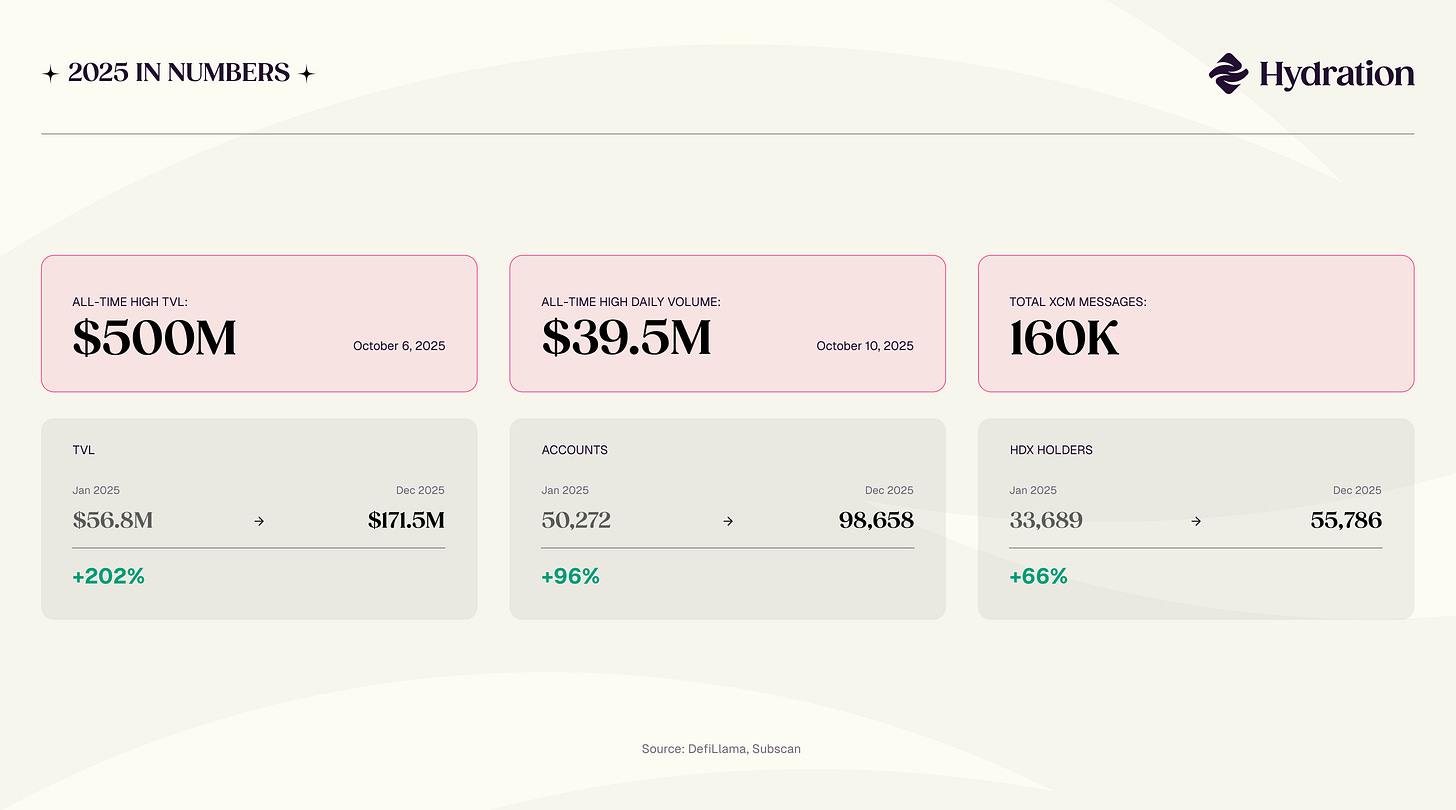

The Numbers

Our TVL journey started 2025 at $56.8M. By June, after the GIGAHydration campaign launched with 2M DOT in incentives, TVL surged 41% in five days, crossing $350M. On October 6th, we hit $500M — an all-time high. Four days later, crypto experienced its largest single-day liquidation event in history. Hydration processed a record $39.5M in daily volume that day. By year end, TVL settled at $171.5M — a 202% increase year-over-year despite the October correction.

Accounts nearly doubled: 50,272 → 98,658 (+96%)

HDX holders grew to 55,786 (+66%)

160K cross-chain messages processed

Looking Ahead

2025 was about completing the stack. 2026 is about making it faster, simpler, and more powerful. The new Hydration web app is coming - it brings us sleeker visuals, faster performance, light-client integration, and improved UX across the board. The light-client architecture allows users to interact directly with the blockchain without relying on a third-party RPC provider. Combined with 2-second block times (with 0.5 seconds on the roadmap), the experience will feel significantly faster and smoother.

On the product side: we’re expanding stablecoin support beyond USD. EURC brings euro stablecoin access, opening Hydration to forex flows and non-USD users — and we’re exploring other non-USD stablecoins as well. ICE (Intent Composing Engine) introduces intent-based trading with MEV minimization and limit orders native to the protocol. Cross-chain intents will extend this execution model across chains. Real-world asset opportunities are on the roadmap — more details to come.

On the strategy side: we’re building for resilience regardless of market conditions. That means deploying protocol-owned liquidity more capital-efficiently — including opportunities that reach beyond on-chain activity into real-world yield. More on this soon.

Thank You

To everyone who provided liquidity, staked, voted, traded, borrowed, minted, and built on Hydration this year — thank you. The vision was always to make DeFi efficient, simple, and unstoppable. The infrastructure is live. The roadmap is clear. Now we keep building.

Stay hydrated! 🚰

ICYMI: Key Reads from 2025

BREAKING NEWS: GIGADOT and HOLLAR The March announcement that previewed the year’s biggest launches.

HOLLAR is here! The full breakdown of Hydration’s native stablecoin and what makes it different.

Newsletter: Jul / Aug 2025 Breaking $400M TVL, boost wars, and the HDX staking rewards boost.

Newsletter: Sep / Oct 2025 HOLLAR scaling, $500M TVL peak, surviving October 10th, and GIGAHydration Phase 2.