Intro to HydraDX (part 2)

“The How”

If you missed the first part of the series click here.

Describing HydraDX to those who have been exposed to traditional AMM models is a challenge. “Few understand” really does apply in this case. Our goal is turning few into many. At last, we have been able to come up with (what we think is) a good enough approach to explain our secret sauce.

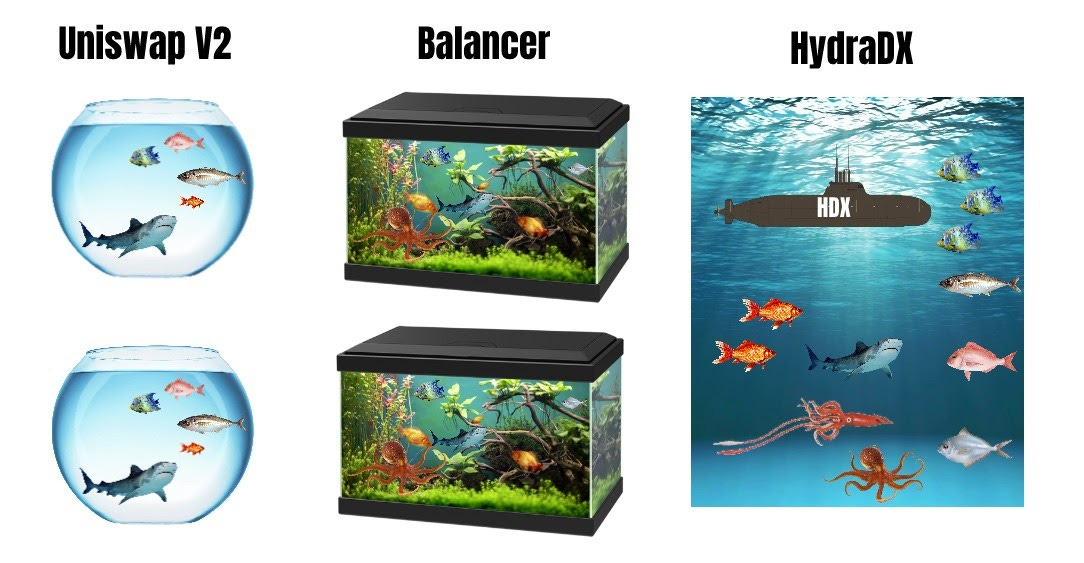

First, there is a pool. Or rather an ocean - one giant omnipool of liquidity. This pool is a decentralized protocol. It has liquidity providers, but the protocol itself becomes a liquidity provider as well.

Imagine having one decentralized entity becoming an honest and active participant of itself.

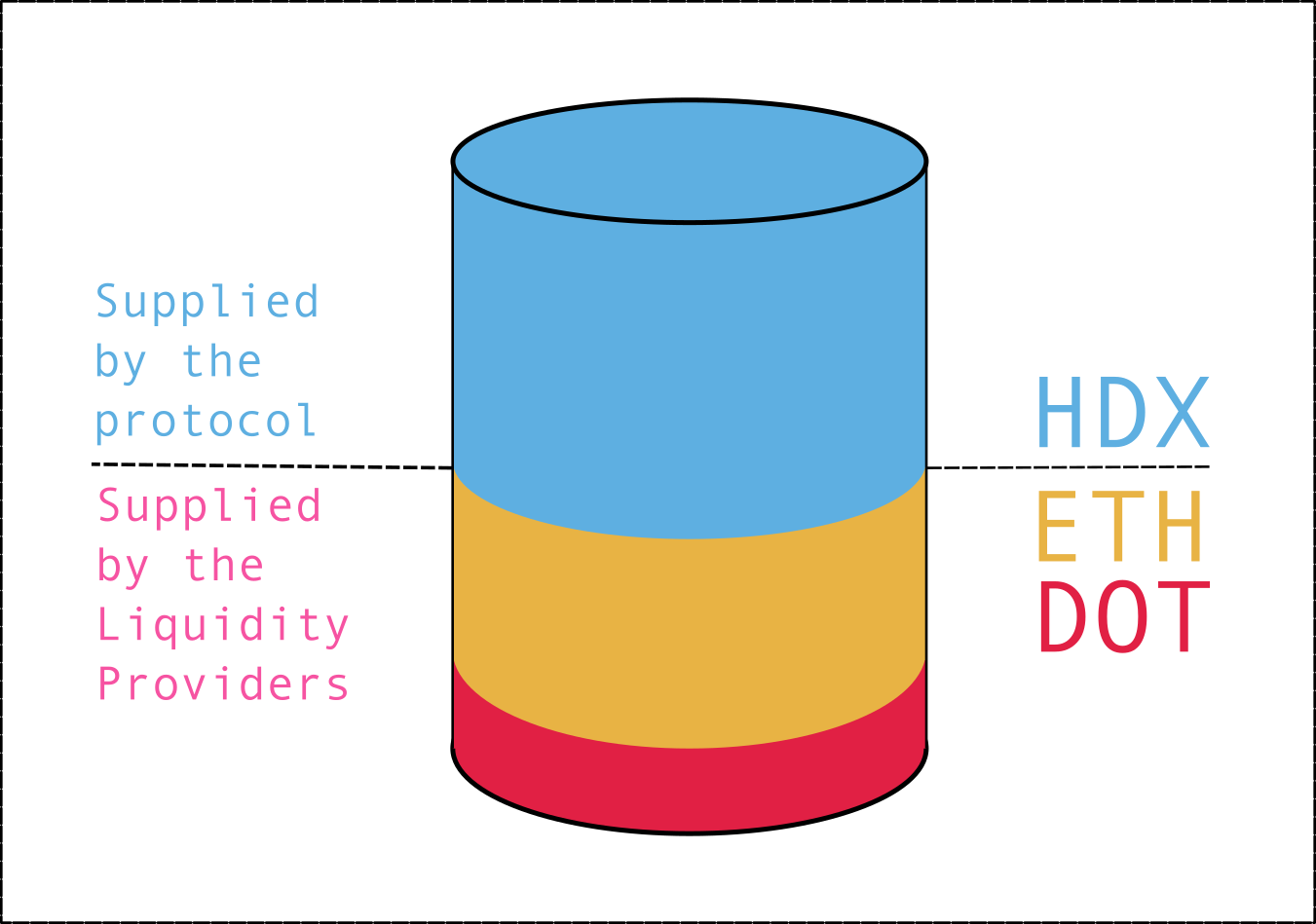

There are two sides to HydraDX omnipool - the "LP" side and the protocol side. There is no need to pay attention or manually intervene with the protocol side of the pool. HydraDX is implementing a novel token model inspired by a bonding curve, designed to handle a pool of n assets and help to coordinate between different actors and the protocol.

The core idea is to have a base asset ($HDX), which is minted and held by the protocol. This asset will represent 50% of the initial value of the liquidity pool. The other 50% of initial value is provided by the liquidity providers in exogenous assets. The 1:1 ratio is kept algorithmically; as assets are added or withdrawn, native tokens are minted or burned accordingly.

HDX tokens remain within the pool until they are bought. HDX can be exchanged for other tokens inside of the pool and can be traded freely outside of the protocol.

In the omnipool, various assets can be priced against one another since they are all priced against a trade-able base asset (HDX). This enables HDX to act as a price oracle, massively decreasing liquidity scattering and the overall slippage currently present in the classic AMM pools (while increasing capital efficiency).

This means you do not have to provision a pair of assets as an LP. You can inject a single asset into the omnipool.

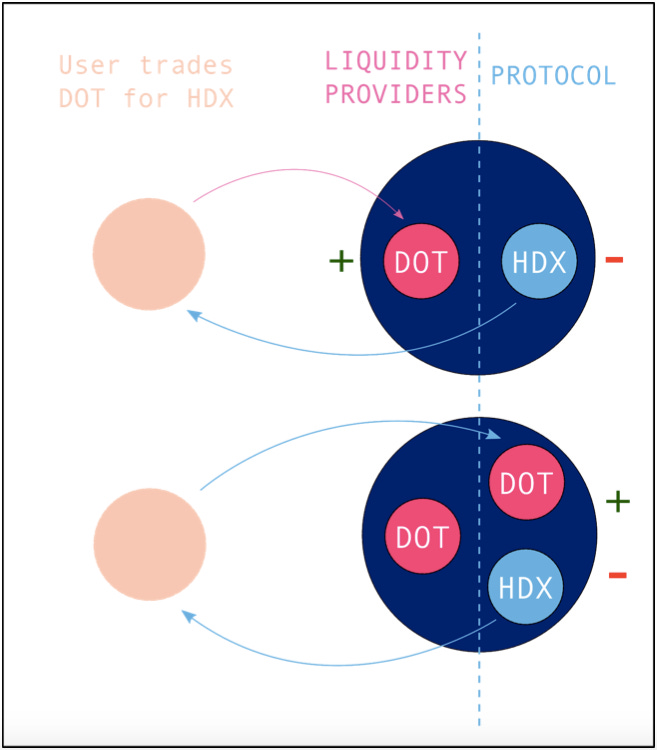

Example:

Assume 1 DOT=10 HDX.

Alice LPs 100 DOTs.

The protocol mints 1000 HDX that remain in the pool.

Bob wants to immediately purchase HDX so he buys 100 HDX from the pool for ~11.1 DOTs. The DOTs that enter the pool remain in the ownership of the protocol. It now owns these 11.1 DOTs, which have become a “protocol reserve”.

Total number of DOTs in the pool is 111.1. The amount of HDX is 900 and the price for 1 DOT slipped to 8.09 HDX.

Bear in mind that this is an extreme case of slippage but works well for the demonstration.

In regards to “the protocol reserve”; all assets used to buy HDX from the protocol side of the pool become a property of HydraDX protocol.

Alice bought HDX for 1 BTC

Bob bought HDX for 10 ETH.

Immediately after these trades, HydraDX starts to provide BTC and ETH liquidity and earns fees on top of them.

This means HDX will be backed by the overall reserves composed of various assets injected into the pool to purchase HDX. The holders will benefit from transaction and trading fees.

HDX becomes a liquidity reserve asset around which the participants form a spontaneously emergent and autonomous organization. AMMs (with an exception) have been largely relying on "governance tokens" which we see as a very weak proposition given that:

AMM governance has been barely real

Extracting a rent without providing work/value is not a sustainable model

To Summarize

There is no reason for liquidity to be fragmented among endless sub-markets (like Uniswap style paired pools). We have designed HydraDX with an ambition of creating a cryptoasset liquidity Schelling point, facilitating a reliable operation and better experience.

The HDX token design brings a flexibility to the protocol that acts as an organism adapting to its current state rather than a rigid structure. The protocol is alive and adjusting itself to handle any inflow and outflow of assets.

Dynamic buy and sell functions are logical improvements for the next generation of AMMs. It is all about balancing between low fees for traders and generating profits for liquidity providers. Implementing fees determined by volatility is a low hanging fruit. The higher the volatility the higher the taker fees.

Additionally, we were able to combine efficiency of CLOB order matching and the best of the AMM. We have achieved this by clearing opposite transactions in one block directly without involving AMM (fees still accrue to LPs). This is an elegant way to execute transactions with zero slippage.

Being a standalone chain enables the critical issues to be prioritized on consensus level increasing chance of execution under harsh conditions (e.g. market panic), leading to lower collateral requirements and lower penalty fees.

The core improvements of HydraDX protocol are:

✅ Deeper liquidity (minimizing liquidity scattering)

✅ Lower slippage

✅ Internal composability

✅ Better execution & UX

Powered By Polkadot

HydraDX is a technologically demanding concept. Not many of the different blockchain technologies out there could handle HydraDX efficiently. Our primary goal was to optimize for the use case and not to make a technological compromise. That’s why we chose Substrate as a base for our project. It provides us with basic building blocks like networking, interoperability layer and consensus, while providing huge freedom for modification and building custom business logic. (It’s also written in Rust which we love.)

The reasoning for choosing Polkadot ecosystem is two-fold:

Next generation tech standard

Thriving organic ecosystem of projects and aspiring cryptoassets

Starting within the Polkadot, we believe HydraDX can play a crucial role in bootstrapping the liquidity of the whole ecosystem of long tail assets to life. HydraDX is built to support entrepreneurs within the Polkadot ecosystem, allowing them to kickstart their projects.

HydraDX strives to become a pluggable middleware for everyone who would like to enjoy seamless token swapping on Polkadot and beyond.

Indeed, looking beyond Polkadot, we believe that bridging to the existing ecosystem is of a crucial importance. We are actively looking into bridging to existing chains, ideally choosing from existing solutions when developed. Our goal is to become a number one liquidity pool for all crypto assets.

To sum up a few reasons why we chose Polkadot and Substrate as a base for our platform:

1. Scalability

2. Interoperability

3. Ability to outsource infrastructure components

4. Upgradability.

5. Shared security

6. Great community

In the following weeks we will release additional technical details. In the meantime, stay tuned for the next instalment of the Intro to HydraDX series. We hope that this article has helped you understand what we are building. To learn more you are welcome to join:

🦸♀️Telegram Channel

bought HydraDx tokens on Balancer exchange and hold my tokens on MetaMask. I set up a Polkadot extension account but when I go to claim the Hydra tokens from my MetaMask account, the Claim site lists my tokens but does not connect it to my Polkadot claim account. On the polkadot site, i can see my Claim Account but it has a zero balance. I am not sure where my HydraDx tokens have gone. Can someone help me?

Can you explain the example? How are you getting a slippage to 8.09HDX? I'm getting 9.09HDX. If Bob in the example exchanges 11.1DOT for 100HDX, then 1DOT = 9.09HDX , right? 11.1(9.09) =100.9 , but 11.1(8.09) = 89.8