The Hydrated Strategy

Revenue Beyond the Cycle

DeFi has a revenue problem. When crypto prices drop, on-chain activity collapses.

When prices rise, everything explodes. Swaps increase, leverage piles on, lending markets boom. Protocols generate fees. Everyone celebrates.

When prices fall, everything stops. The on-chain economy collapses into deep recession. Protocols that were swimming in revenue six months ago now scramble to cut costs and extend runways.

This cycle repeats endlessly. And after October 10th’s market shock, the entire industry knows it can’t continue.

Most projects are responding by waiting. Hoping. Praying for the next bull run to save them. Capital is leaving crypto. Talent is moving to other industries. Projects are imploding.

Hydration is taking a different path.

The Commoditization Crisis

Let’s be honest about where we are. Every piece of crypto infrastructure is becoming commoditized. AMMs, bridges, oracles, L2s - all of them increasingly generic and cheap. Profit margins are compressing across the board.

Well-funded Silicon Valley startups are aggressively subsidizing use cases to crush competition. The era of building cool tech for years without real utility is over. Now everyone suddenly cares about revenue, sustainability, and traditional business metrics.

The survivors will be protocols that can generate meaningful revenue regardless of market conditions. Not revenue from trading fees that evaporate when prices drop. Real revenue from real economic activity.

But there’s a catch: mistakes in crypto can be fatal. Users demand safety above all else. That’s why new DeFi protocols struggle to take market share from incumbents, even when they’re more innovative. Trust and security are the ultimate moats.

Hydration has spent years building that moat. Rate limiters for suspicious deposits. Transaction blocking for potential exploits. Chain-level optimization for fund security. When pitching institutional players in Buenos Aires recently, the security-first approach generated more interest than any other feature.

Now it’s time to put that foundation to work.

Three Products, One Strategy: Real Yield from Real Economy

Hydration’s strategy centers on becoming a credit provider - the highest profit margin use case in all of crypto. Not just minting stablecoins (which requires demand to be useful), but providing actual liquidity and credit where people desperately need it.

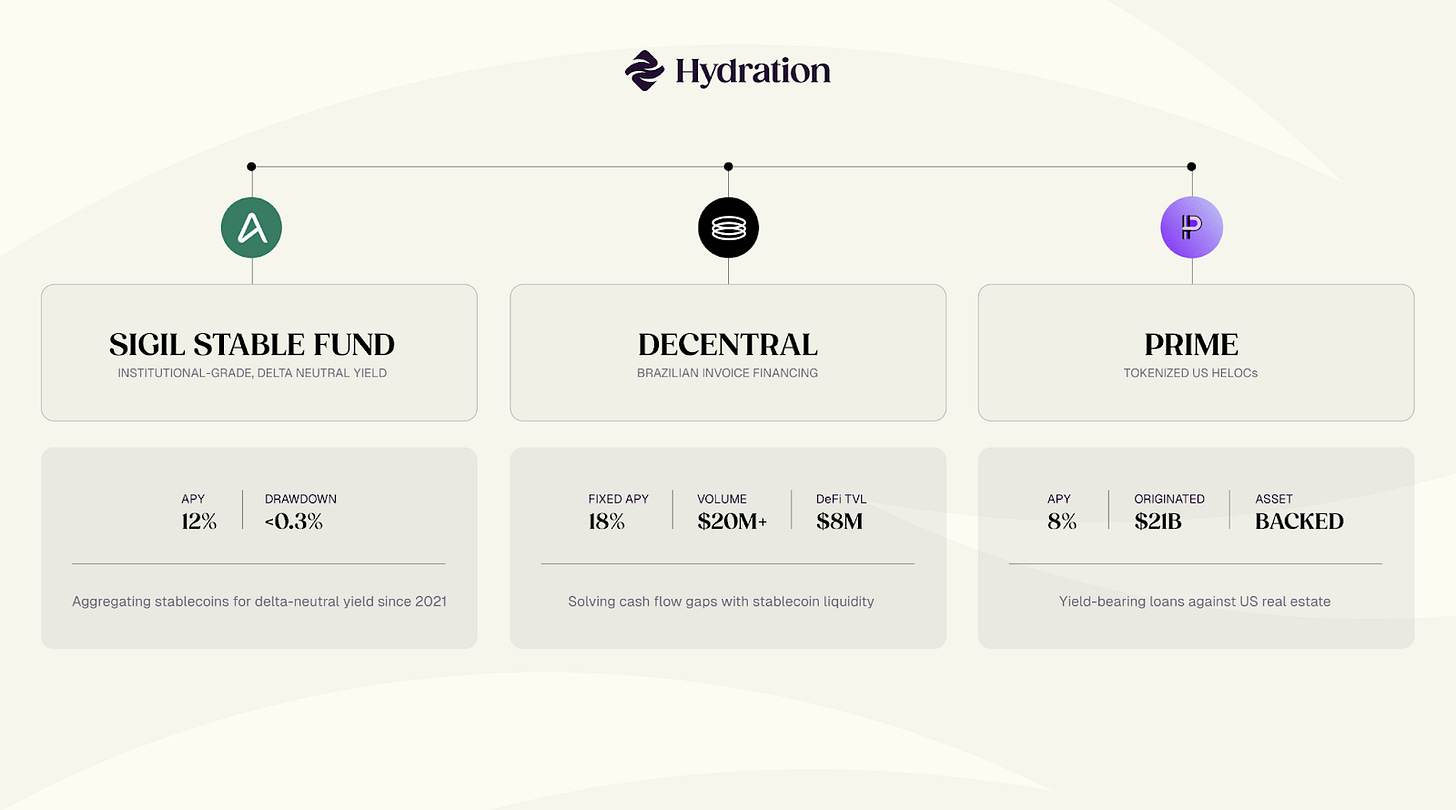

The plan deploys capital across three distinct yield-generating products, each solving real problems in the real economy:

1. Sigil Stable Fund: Institutional-Grade Delta Neutral Yield

Sigil Stable fund, operated by early Hydration backer Fiskantes, has been running since 2021 with zero drama, no significant drawdowns, and a spotless track record. The fund aggregates stablecoins and provides risk-adjusted yield through delta-neutral strategies.

The numbers: roughly 1% monthly yield (12% APY), with only 0.3% drawdown during October 10th’s chaos - a day that destroyed many funds. Hydration’s R&D provider Intergalactic Limited is already using Sigil for treasury management.

The mechanism: The Hydration Treasury creates synthetic collateral representing its positions at Sigil, manually priced to avoid liquidation risks from oracle malfunctions. The Treasury can borrow USDT, USDC, and HOLLAR against these positions. The interest earned continuously strengthens HOLLAR’s peg through rebasement effects.

2. Decentral: Brazilian Invoice Financing

Here’s a problem most people don’t think about: Brazilian creators and agencies wait weeks or months to get paid by corporate clients. Meanwhile, Brazil’s base interest rate sits at 15%, and traditional financing options often hit usurious levels.

Decentral spotted the arbitrage opportunity. They connect cheap DeFi liquidity to businesses with reliable receivables who need immediate payment. Companies sell their invoices at a discount. Decentral provides instant liquidity, handles currency hedging (USD stablecoins to Brazilian Real), and generates 18% fixed APY for liquidity providers.

The operation isn’t theoretical. Decentral is already running at scale across Ethereum, Polygon, Base, and other chains with $8M in TVL, $3.5M in annual recurring revenue, and over $20M in total volume processed. They’re currently liquidity-constrained with $80M in immediate demand.

Every receivable goes through rigorous validation: contract authenticity verification, payment history assessment, counterparty risk filtering. Only performing receivables with clear settlement schedules qualify for financing. The DUX Group, a Brazilian financial group specializing in receivables financing, handles origination, underwriting, and operational governance.

For Hydration users, the structure is straightforward: 60-day cycles with accumulated interest available every 60 days. Principal can be redeemed after the minimum 60-day period with 48 hours notice.

This is real yield from solving real problems. Not dependent on leverage plays or hoping crypto prices go up. Just tapping massively underutilized DeFi capital for productive economic activity with proven demand.

3. PRIME: The Game Changer

PRIME is a yield-bearing token representing tokenized US HELOCs (Home Equity Lines of Credit) - loans against debt-free real estate in the United States.

Figure Technologies, the largest non-banking HELOC provider, has originated $21 billion in loans. They went through deep due diligence before listing on NASDAQ (ticker: FIGR) last year. Nobody wants to repeat 2008, so the scrutiny was intense. They passed - and PRIME is backed by only the highest quality prime mortgages.

PRIME pays 8% APY from homeowners repaying their loans, backed by real estate collateral - one of the highest quality assets available.

But here’s what makes PRIME special for Hydration: composability.

Anyone can mint PRIME on Solana with USDC and bridge it to Hydration via Wormhole in minutes. No permissions. No gatekeeping. Just capital flowing to where it produces returns.

More importantly, PRIME is usable as collateral.

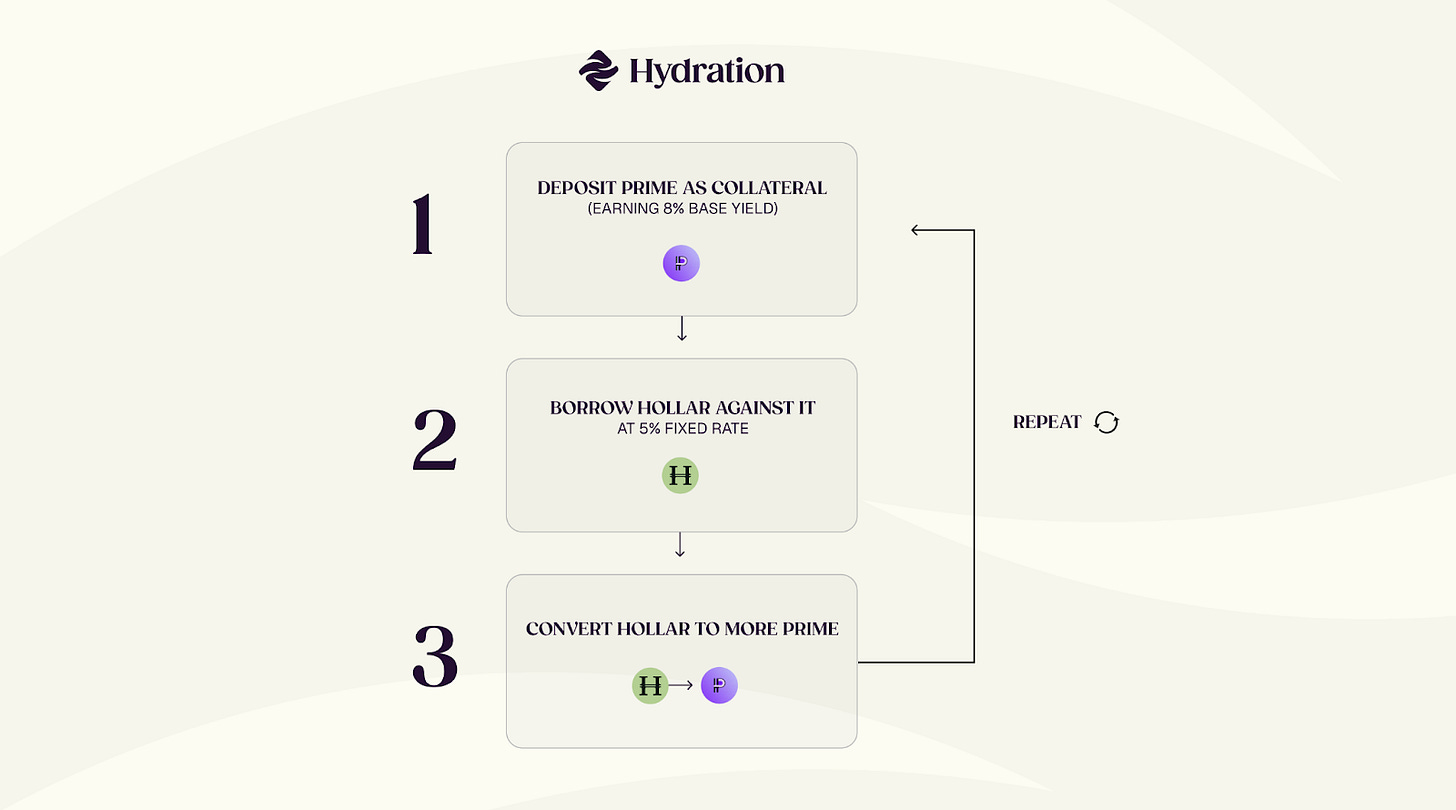

The Looping Strategy: 15-20%+ Fixed Yield

Here’s the breakdown of the looping process:

Deposit PRIME as collateral (earning 8% base yield)

Borrow HOLLAR against it at 5% fixed rate

Convert HOLLAR to more PRIME

Repeat

Each loop captures the 3% spread between PRIME’s yield and HOLLAR’s borrow rate. With modest leverage, users can push real yields into 15-20%+ territory without any token incentives. Fixed rates, not floating. Certainty, not volatility.

Similar strategies on Kamino fluctuate wildly because borrow rates change constantly. Hydration’s fixed rates provide something rare in DeFi: predictability.

This solves Hydration’s biggest missing piece: HOLLAR demand.

Borrowing HOLLAR generates the highest revenue margin in the protocol. 100% of interest paid goes to Hydration, versus 10% for typical lending. Same model that makes Aave’s GHO profitable.

PRIME creates a permissionless, scalable, low-effort savings product for everyone. High yield, quality collateral, reasonable risk, minimal monitoring. No exclusive access required. No complex strategies to babysit.

And unlike Sigil or Decentral, PRIME can absorb multiples more capital. This scales.

The Execution Plan

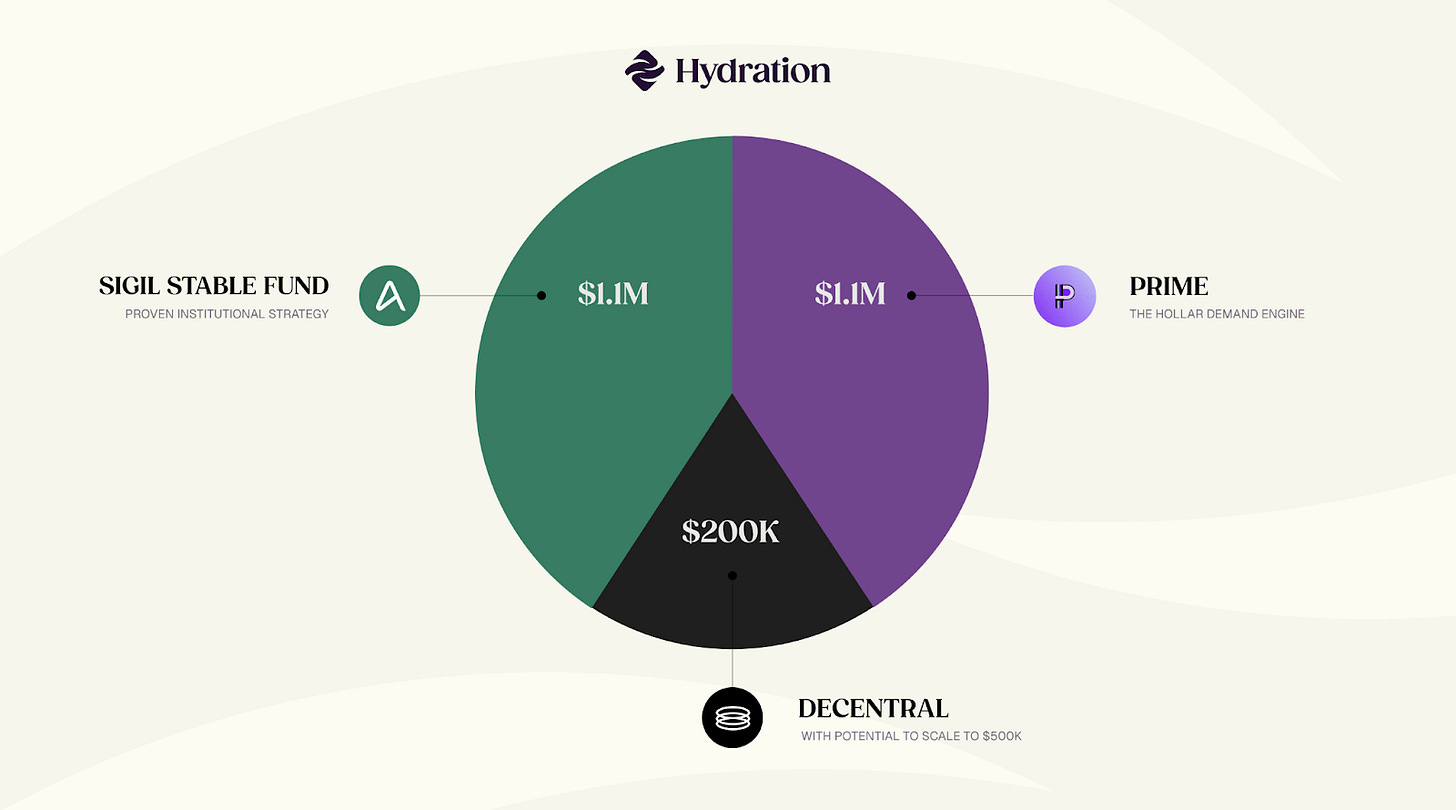

Hydration currently holds roughly $14M in non-HDX treasury assets. The immediate plan would be to deploy $2.7M from existing stablecoins previously allocated for the HSM:

$1.1M to Sigil Stable Fund (proven institutional strategy)

$1.1M to PRIME (the HOLLAR demand engine)

$200K to Decentral (real-world Brazilian commerce, with potential to scale to $500K after successful redemption)

Timeline: Allocated over two weeks.

But here’s the aggressive part: front-loading the yield.

Rather than waiting months for yield to accumulate, the strategy takes 3% of principal upfront (assuming it will be generated anyway) and uses it for immediate DCA into Protocol Owned Liquidity:

(t)BTC - the obvious choice

(G)ETH - long-term looping strategy potential

(G)SOL - another major with looping possibilities

PAXG (tokenized gold) - experiencing massive comeback as a reserve asset with serious demand from retail, institutions, and central banks globally

This builds Hydration’s balance sheet immediately while crypto prices are struggling. Most projects would kill for this opportunity - growing high-quality assets without external funding.

Beyond Treasury: A Product for Everyone

This strategy goes beyond treasury management. Beyond a one-time deployment capped at $2.7M.

This is Step 1 of building infrastructure for anyone to access these strategies.

Individual users, organizations, DAOs, projects - all can use these yield products for:

Covering operational costs (development, marketing, audits, insurance)

Growing reserves while keeping principal intact (DCA into majors, fiat stables, tokenized stocks/commodities)

Funding buybacks or building insurance funds

All of the above

These are the exact products demanded by high-net-worth individuals and corporations looking for stable, predictable returns backed by real assets.

The goal is reaching escape velocity where protocol R&D and operations are fully covered by yield as early as possible. Where buybacks have material impact. Where volumes grow regardless of whether BTC is at $40K or $100K.

The Urgency

Let’s be clear about the stakes.

Competition is fiercer than ever. Incumbent protocols face serious challenges. Neither situation will improve soon.

Projects are dying. Capital is leaving. The window of opportunity won’t stay open forever.

Hydration has the foundation - battle-tested security, direct value capture, a strong community. But foundations don’t matter if you don’t build on them.

This is the mobilization moment. Prove that Hydration can generate sustainable revenue. Prove that DeFi doesn’t need to wait for bull runs. Prove that real utility (solving real problems for real people) is the path forward.

The on-chain future is bright for those who survive and get there.

The question: what’s the alternative?

Waiting for prices to recover? Hoping for the next cycle? Watching the runway shrink month by month?

Or building a survival protocol - one that thrives in any market by connecting DeFi liquidity to genuine economic demand.